|

“State government must be leaner and more efficient while still being responsive to residents. This is the beginning of a new way of doing the state’s business, one that will certainly lead to cost savings for taxpayers, but as importantly, will make it easier for citizens and businesses to work with government. State agencies are not immune from the same decisions being made in corporations and households across the state — doing more with less — and this step will ultimately give us a leaner, more efficient Connecticut.”

—Governor Dannel P. Malloy outlining plans to significantly reduce the number of state agencies, June 30, 2011

|

The rapidly changing pace of technology provides significant opportunities to transform how government provides services. Connecticut undertook initiatives to modernize the relationship be-tween the state and its employees, Governor Malloy oversaw a major renewal of the technology state agencies rely on to provide responsive, cost-effective services. The state upgraded systems, implemented new technologies, enhanced security, and added new data centers to ensure business continuity.

Progress during the Malloy administration

In March 2013, a directive was issued to all state agencies to begin utilizing project management tools and process improvement methodologies such as LEAN to become more efficient and customer-focused. Since its inception, LeanCT has continually assisted state agencies achieve progress on process efficiencies, improve service to the individuals they serve and support, and maintain high levels of quality.

Through the LeanCT initiative, more than 3,000 state employees, and nearly 200 nonprofit provider staff members were trained to use Lean tools and principles to improve service delivery. LeanCT actively encourages participation in process improvement initiatives by more than 40 Executive branch agencies, several nonprofit provider agencies, municipal leaders, and the Legislative and Judicial branches of state government. As a result, hundreds of processes were analyzed and streamlined. LeanCT has empowered employees to eliminate waste, remove redundant steps, and add standardization across programmatic, agency, and even, industry lines. In a survey of state agencies in 2018, respondents reported that they had successfully utilized Lean to mitigate the impacts of staff and/or budget reductions between 2013 and 2018.

Through its work and accomplishments, LeanCT assisted the State of Connecticut in becoming a national leader in its efforts to align people, process and technology, to enable service delivery in the most cost efficient and effective manner. In 2017, Connecticut was honored as a leader in the Lean Government field, as a recipient of the 2017 Bright Idea Award by Harvard University’s Ash Center for Democratic Governance and Innovation at the Harvard Kennedy School. Connecticut was also the recipient of a 2017 Bright Idea Award for its modernized regulations website. In 2015, LeanCT was highlighted as a national model for Lean Government Practices by Gemba Academy and in 2017, Connecticut was featured in GovTech online publication for the state’s use of Lean tools prior to process automation.[46]

Process improvement methodologies, including Lean, is now a critical part of Connecticut’s management process and entrenched in the culture. One of the most significant shifts in this regard was evidenced by the coordination between the LeanCT program and the IT Capital Investment Program. Through this collaboration, it became commonplace for an agency to use process improvement techniques to streamline their workflow prior to requesting funding from the IT Investment Fund for a technological solution. While this may seem like an obvious course of action, it was a significant cultural shift in the way agencies approached the use of IT to improve business outcomes. The two programs work closely to identify opportunities for inter-agency collaboration, common technology needs throughout state government, and best practices across the system, while promoting the concept of improving any process prior to automation, and supporting state agencies in their implementation of this philosophy.

Highlight: Connecticut Insurance Department

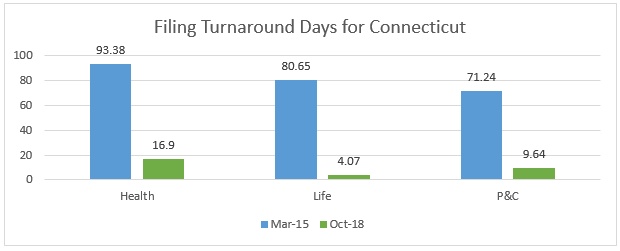

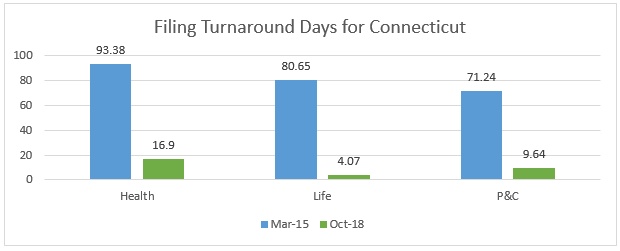

Beginning in 2015, the Connecticut Insurance Department (CID) undertook a number of Lean initiatives to improve its efficiency and effectiveness. These initiatives have further enhanced Connecticut’s reputation as a domicile of choice for insurance companies.

Results achieved include the following:

- Financial Regulation moved to a software platform that allows for easy sharing of information between in-house examiners at the Department and the field examiners on-site at the companies.

- The actuarial unit increased the use of in-house expertise to manage outside consultants used for financial exams. That approach allowed the unit to cut a carrier’s cost nearly in half for a financial exam.

- The Department recently implemented changes to its process for licensing out-of-state companies applying for admittance to write business in Connecticut. The improved process has meaningfully reduced the waiting time for the review and decision on applications and further progress is expected this year.

- Licensee service improvements for the more than 230,000 agents, brokers, adjusters and bail bonds agents were created through online applications and renewal notices, phone system improvements, an online payment portal and an improved communication on the Department website. These initiatives made the CID more user friendly for licensee and reduced redirection of questions, and saved postage, paper and internal production costs.

- Product filing review in the Life and Health and Property and Casualty Divisions are within 30 days, which is the regulatory best practice standard. A more than four year backlog of more than 700 property and casualty filings was eliminated in 2017.

The Insurance Department dramatically improved processing times for review of filings in its Health, Life, and Property and Casualty Divisions.

Highlight: Connecticut Department of Motor Vehicles

In 2011, the state Department of Motor Vehicles (DMV) was seen as an unwieldy bureaucracy whose operations forced long wait times on customers and showed no major signs of change to meet 21st Century demands for quicker, more efficient, and online services. Aging computer systems, outdated policies, and unnecessary paperwork created hurdles customers often faced for many routine tasks.

The Governor ordered steps to cut red tape, reduce wait times, improve online customer services and search for innovative ways for modernize service delivery for customers. Chief among the major changes that followed was the reconstruction of a more than 40-year-old computer system for registering vehicles. In a strategic approach, coupled with other technology improvements and streamlining behind-the-scenes bureaucracy, all these improvements focused on putting the customer first.

Additional accomplishments brought about this modernization include:

- Wait times in offices dropped by a seasonally adjusted 55 percent after using data-driven analysis (2016 compared to 2015). Wait times are also posted online and updated every five minutes.

- A 36 percent reduction in phone center customer wait times.

- A significant drop in return trips to DMV because of missing paperwork resulting in about 90 percent of customers served at a window complete their transaction.

- Developed the agency’s first mobile application, Connecticut DMV Mobile that features DMV wait times and locations, online services, practice learner’s permit tests and ability to schedule a learner’s permit knowledge test.

- Digitized and automated voter registration at the DMV.

| IT CAPITAL INVESTMENT PROGRAM |

The IT Capital Investment Program was established in 2012 to counter years of neglect and make strategic investments to upgrade technology and create systems across agencies that make state government more efficient and user-friendly.

The challenge for Connecticut was the high cost to fix or upgrade all of its technology systems on an individual basis. That’s why the IT Capital Investment Program leveraged its investments in technology by taking an enterprise-wide approach wherever possible and focused on creating systems that are interoperable and involve shared services and applications.

Prior to establishment of the IT Capital Investment Program, the Center for Digital Government (CDG), the longest-running examination of technology use in state government, ranked Connecticut in the lowest third among states in IT leadership, service delivery, citizen engagement, innovation and collaboration. Investments in technology were less than 1 percent of operating expenses, while experts recommend that best practice enterprises in both the public and private sector spend an average of 4.1 percent.[47] Between fiscal years 2013 and 2019, the IT Capital Investment Program has worked with authorized funding of $376 million to invest across nearly all functions of government.[48] In 2014, Connecticut achieved one of the biggest improvements in the CDG Survey.[49]

Other noteworthy projects that are a direct result of the Capital IT Investment Program include:

- The state modernized the hiring process by implementing JobAps, a state-of-the-art job application and recruitment system, which eliminated approximately $40,000 in annual paper, supplies, and testing venue expenses.

- Unemployment Insurance modernization with self-service capabilities which is expected to result in approximately 44,457 less hours of Department of Labor staff time per year spent processing transactions on behalf of claimants and employers.

- The Department of Revenue Services (DRS) automated its document management process reducing paper storage by more than 60 percent. Previously, it could take 10 weeks or more to get taxpayer information back from external data capture vendors, but now it is available in real time.

Human Service Improvements

Connecticut positioned itself as a national leader for its efforts to align people, process, and technology to enable service delivery in the most cost efficient and effective manner.

In particular, through the IT Capital Investment Program, the state funded 75 improvement projects across all areas of state government.

Perhaps no agency saw more dramatic results than the Department of Social Services (DSS), which made vital upgrades to its processes and nearly three-decade-old systems. Importantly, DSS was able to use their funding from the IT Capital Investment to leverage a 90 percent match — nearly $300 million — from the federal government.

Through the program:

- DSS implemented business processes to streamline service delivery to residents. Previously, more than 95 percent of DSS customers left a regional office without having completed their business. After the implementation of new business processes, fewer than 15 percent of customers needed to return or return or make additional contact with the agency to complete their intended transaction.

- Online customer portals were created allowing 245,369 residents to apply for benefits online, rather than through the mail or an in-person visit. As of June 2018, nearly 250,000 residents had created online accounts, allowing them to submit and obtain information without staff intervention.

- More than 20 million documents were digitized, eliminating vast amounts of paper documents awaiting processing.

In addition to the overall success of the department’s service delivery, the Supplemental Nutrition Assistance Program (SNAP) saw a tremendous improvement. For decades, SNAP was a problem spot for the state, by federal standards, and Connecticut was in real danger of being assessed millions of dollars in financial penalties. The program ranked 41st and 44th nationally in key administrative accuracy measures. Timeliness in granting benefits was 53rd nationally, below all other states and territories operating SNAP programs. Staff at the Department of Social Services were working hard under a deluge of paper applications that had risen greatly with the Great Recession, but processing and infrastructure deficiencies were undercutting their efforts.

Flash forward to 2018, DSS is operating a very different SNAP program. Performance measures now rank Connecticut fifth best out of 53 states and territories in application processing timeliness, completing a rapid and unprecedented rise from last in 2011, 2012 and 2013. In fact, DSS now expedites benefits to the neediest households in 1.5 days on average, well below the seven-day federal requirement. Administrative accuracy measures have also substantially improved. The department’s payment error rate is below the national average of 6.3 percent and continues a trend of significant improvement since 2013. About 375,000 low-income residents — including more than 138,000 children — were receiving assistance to put food on the table and make ends meet in 2018. And more than $52 million in federal revenue is pumped into Connecticut's food economy each month.

Through process improvement and prudent investments in technology, and dedication from DSS employees, the state:

- Launched “ConneCT” in July 2013, a business modernization project which replaced piles of paper on individual workers’ desks with electronically scanned documents available to any worker in the state. There are no paper case files to misplace, and clients can be served by any eligibility worker in the state.

- Developed online applications, renewals and change reporting to streamline customer access and staff workflow.

- Replaced outdated local phone systems with a centralized modern phone system. Clients can now call one number and be served by eligibility workers statewide, clients can also get most information about their benefits at the push of a button, online, or via phone unassisted, 24/7. More than 2.5 million calls have been processed since the July 2013 launch of ConneCT.

Connecticut has become a pioneering leader in making data available to the people of Connecticut. In fact, the state’s efforts related to Open Data were nationally recognized on multiple occasions in the past eight years.

With Executive Order No. 39[50], Governor Malloy created the Connecticut Open Data Portal to serve as an online portal where data collected across all state government agencies would be shared with the public. Between February 2014 and June 2018, Connecticut made huge strides in increasing public access to important government datasets. In this time, state agencies released more than 630 datasets consisting of more than 110 million rows of data. The state’s Open Data Portal[51] was accessed more than eight million times by June 2018.

Data from the site has been used to:

- Develop a tool that can predict the likelihood of drug overdoses, helping first responders and hospitals ensure they are prepared in advance;

- Help families make informed decisions when selecting day or summer camps by making Office of Early Childhood inspection results of child care facilities available to 211; and

- Create a more efficient municipal permitting system for both local officials and those seeking permits by data made available from the state’s licensing system.

To ensure this important work continues, Executive Order 39 was codified, establishing a coordinated strategy to manage and treat data as a strategic asset. Public Act 18-175[52] enabled OPM to establish policies and principles to ensure the state’s data is more effectively managed and used to support a more effective government.

Criminal Justice Systems

Continued investment in criminal justice reforms is one of the hallmarks of the Malloy administration with substantial results. In support of these initiatives, the state completed nine releases of the Criminal Information Sharing System (CISS) into production. CISS is a comprehensive, statewide Criminal Justice Information System (CJIS) technology established to facilitate electronic information exchange between stakeholders having any cognizance over matters relating to law enforcement and criminal justice.

CISS includes modern search capability of CJIS data and real-time workflow of actionable information.

During this time, multiple state and local agencies collaborated to replace the aging and outdated 911 system with a state of the art Next Generation 911 system. This system handled 2 million 911 calls statewide in 2017. This new system includes many new features designed to improve citizen and first responder safety, including the automatic rerouting of calls for Public-Safety Answering Point (PSAP) outage and call overflow conditions, and Text-to-911 capabilities.

Partnering with Local Government

The state also prioritized technology partnerships with local government. The state expanded its research and education network (CEN) to include municipalities for high-speed broadband access. In the last two years (2016-2018), the state expanded connectivity from 70 to more than 100 municipalities, and expanded access to the state’s libraries, bringing the total number of fiber connected libraries to 136 (out of 193). This investment reflects the critical role libraries play in improving digital literacy and helping to provide greater access to technology resources across the entire state.

The Connecticut Commission for Educational Technology applied an innovative solution for the problem of keeping our students’ data protected. Instead of having more than 1,000 schools independently vet and negotiate terms of service agreements — at an indirect cost to districts of more than 80,000 staff hours statewide — the state implemented a hub to allow software providers to digitally sign the Connecticut Student Data Privacy Pledge. In year one alone, the initiative has resulted in a 7,000 percent return on investment, with a 25 percent quarterly increase in usage since its launch.

Additional evidence of the sharing of state resources to improve capabilities, at lower cost, was the introduction of Distributed Denial of Service protections to the CEN. CEN added this capability in 2017 and has mitigated more than 200 attacks in this fiscal year alone. No school, library or town could afford this protection on their own, but by leveraging the network, all participants have been protected from this growing cyber risk.

| IMPROVED AND EFFICIENT STATE IT STRUCTURE |

Connecticut moved from a primary data center facility costing the state more than $6 million per year to an innovative public-private arrangement resulting in the reuse of an existing private data center. Along the way, the state consolidated 275 physical servers to 50 physical servers providing hardware, software and power savings.

The State of Connecticut Judicial Branch moved into the State’s Groton Data Center in 2016. They originally requested $25 million in funding to build out and move to a new data center. Utilizing this method, they reduced capital needs by $16 million.

Finally, the State moved from an older-style disaster recovery approach to a joint agreement between Connecticut and Massachusetts to utilize the Springfield data center facility. This change allows the State to have real-time data backup and critical system resiliency and introduced a flexible computing model that prepared the state to use cloud resources all at a lower price.

| MODERNIZING THE STATE WEBSITE |

Prior to 2011, the State of Connecticut’s official website, which acts as a portal to every agency in state government, used outdated 1990’s web technology and residents still could not perform many basic interactions online.

By late 2011, the state began a modernization process and complete redesign of its online presence in an effort to increase usability, convenience, transparency, and access for its visitors. The state accomplished this by using a self-funded plan under a unique public-private partnership that allows the portal to be developed and operated without tax dollars.

Designed for use on computers, tablets, and mobile devices, the state’s new website was completely redesigned to prioritize the features and services that residents most frequently access. State agencies now have the ability to increase the number of interactive, online transactions that residents can complete over the internet, eliminating the need in many cases to use old-fashioned paper forms. The number of available services that can be completed online continues to grow on a regular basis to this day.

| ONLINE PUBLISHING OF STATE REGULATIONS |

For decades, the only way members of the public could obtain copies of state agency regulations was through hard copy documents available through commercial legal material providers. Records on individual regulations were kept in hard copy by the agency writing the regulations. Prior to 2011, Connecticut had become one of the only states in the nation that did not have its agency regulations available to the public over the internet.

Upon taking office, Governor Malloy directed his staff to work with state agencies on a project to make all state regulations easily accessible to the public online. Then in 2012, a law codifying into state statute that all regulations must be published on the internet to ensure that this transparency effort continues was passed.[53]

Today, Connecticut has a state regulations website[54], which was awarded the 2017 Bright Idea Award by Kennedy School’s competition. Connecticut was also the recipient of a 2017 Bright Idea Award for LeanCT. Funding for the regulations project was provided through the IT Capital Investment Program and is an example of the Program’s impact on successfully implementing technology projects across multiple state agencies.

Not only does the website make available all agency regulations over the internet for the first time ever, but it also provides several interactive features, such as allowing users to easily search terms to find regulations and use search filtering to find information faster. In addition, members of the public can read regulations that have been proposed by an agency but not yet adopted, and a chronological record is kept of each proposed regulation as they proceed through that process. After a proposed regulation has been drafted and becomes open for public comment, users are able to submit a comment directly through the website, and can also read other users’ comments. An alert feature allows the public to sign up for email notifications when agencies post information to the database, providing the public with greater ability to monitor regulations.

| MODERNIZATION OF STATE FACILITIES |

Another key initiative was to reduce the costs associated with leasing space for state agencies, as well as to maximize the utilization of state owned space. With an emphasis on efficiency, both leased space and state owned space allocations were reduced resulting in space standards more aligned with the private sector, thereby reducing overall costs.

The state successfully reduced leased space from approximately 3.12 million square feet in 2011, to approximately 2.5 million square feet planned by 2019, resulting in a reduction in leased costs from approximately $63.5 million to $53 million annually. Equally important, through this endeavor the state acquired and modernized more than 1,000,000 square feet of new space, as well as more than 350,000 square feet of existing state space. This vision resulted in the relocation of more than 3,000 state employees and students to downtown Hartford and the establishment of modernized facilities to use for decades into the future.

From the onset, the administration encouraged the ownership or leasing of modern buildings to replace obsolete facilities, thereby achieving cost and energy efficiencies, maximizing delivery of services to the public, increasing utilization of mass transportation, and providing a comfortable and space-efficient work environment. Additionally, a transparent, all-encompassing inventory of state owned and leased real property was created.[55]

State government must continue to modernize its approach to the delivery of services. In order to do this in the most cost effective manner there must be continued coordination of employee effort, sharing of information, and upgrades of outdated technology. As the world continuously changes, so must Connecticut’s approach to delivering quality services and supports to our residents.

The state should become more effective by finalizing the State Data Plan and complete agency inventories of high value data, as required by Public Act 18-175.[56] Further, the next administration should coordinate efforts between the IT Capital Investment Program and the final State Data Plan to enhance standardization and integration of data systems and data management practices across all executive branch agencies.

As the culture has begun to change in state agencies, Connecticut should continue to promote process improvement principles and activities throughout state government, focusing on customer value, performance outcomes, and process efficiencies. Our work in this area is far from over, and must be encouraged to continue in the future. Focusing on improved service delivery, efficiency, and modernization is the only way to move Connecticut forward. Of critical importance, Connecticut must continue to invest in the IT Capital Investment Program. Several projects are underway and require continued funding. The next administration should sustain budget authorization commitments in Fiscal Year 2020 and Fiscal Year 2021 at $50 million per fiscal year. This will ensure critical projects at the Department of Administrative Services, Department of Revenue Services, Department of Labor, Department of Emergency Services and Public Protection, Department of Social Services, and Department of Children and Families move forward, improving the way the state services its residents and reducing the cost to deliver those services.

46. GovTech Online: Technology is a Tool, Not a Solutions in Connecticut’s Journey to LEAN

47. The Gartner Group IT Key Metrics Data

48. CT Open Data: IT Capital Investment Program by Function of Government

49. Government Technology: Which States Have the Best Technology? Digital States Survey 2014

50. Governor Malloy's Executive Order No. 39

51. https://data.ct.gov

52. Public Act 18-175: An Act Concerning Executive Branch Agency Data Management and Process, The Transmittal of Town Property Assessment Information and The Suspension of Certain Regulatory Requirements

53. Public Act 12-92: An Act Transitioning the Regulations of Connecticut State Agencies to an Online Format

54. Connecticut eRegulations System: Portal to Connecticut Regulations

55. CT Office of Policy and Management: Inventory of Real Property

56. Public Act 18-175: An Act Concerning Executive Branch Agency Data Management and Processes, the Transmittal of Town Property Assessment Information and the Suspension of Certain Regulatory Requirements

|